Driven by Data.

Done by Dave.

What’s the Difference?

Buying or selling a home is likely the most significant financial event in your life. That’s why I take a scientific approach to guide you through the process. Using data as our compass, I’ll provide you with the crucial information needed to make informed decisions. Together, we’ll evaluate market conditions, home comparables, timing, and more to ensure you get the best possible outcome without leaving money — or your dream home — on the table!

How Does It Work?

Every process is slightly different, but below is typically how I prefer to handle my transactions to make sure I’m not wasting your time and I’m providing valuable information to you!

Step 1: Reach Out and Say Hi! 👋

I’d love to hear from you to learn how I can best help! Typically, the best “first step” is to fill out this form (below), as it gives me the information I need to conduct market analysis and have a beneficial first conversation.

Not ready for all that? Email, Text or Call!

- HomesByDataDave@Gmail.com

- (484) 440-9596

Step 2: Market Analysis & Consultation

Once I hear from you, I will be working behind-the-scenes to conduct market analysis in the area specific to you (1-2 days). The purpose of this is to arm you with the data and information you need to make an informed decision! Typically, I will share this information with you on our initial conversation so you know what I offer and you have an understanding of market conditions.

Step 3: Prep & List/Offer

This process looks a bit different depending on if you’re a buyer of seller (obviously!).

Buyers – Timing is everything! Acting quickly is paramount when it comes to landing a sought-after home. And for this reason, I will be setting up email automations so you are aware as homes come on the market (if not prior to!). Once you see the home and are ready to submit an offer, we will develop a strategy to help you put your best-foot-forward given the specific circumstances.

Sellers – The setup and staging makes all the difference when it comes to selling your home! The goal isn’t to “sell it”, it’s to sell it for the most we can, and by being thoughtful about how we approach the staging is fundamental to the success that follows. We will work hand-in-hand to get your home staged, photographed and listed in order to not leave money on the table!

Blog & Best Practices

As a part of my offering, I spend a considerable amount of time establishing best practices and a “point of view” on how to approach Buying & Selling! This is all for your benefit, and we want the decisions we make to be informed by data and market conditions. Take a look!

About & Contact

Reach Out!:

Email – HomesByDataDave@gmail.com

Call/Text – (484) 440-9596

My Semi-Short Story:

The Fixer-Upper (2016): Coming out of college, I worked in sales for a number of years before settling into the advertising industry. I found a home at a few agencies over 5 years, during which time I ended up purchasing my first home in Manayunk which was a true fixer-upper. This was a quick sale; I saw two homes and bought one of them, knowing what I wanted and getting it bought under-ask. The goal was to living there for a few years, watch YouTube videos, fix it up and then turning it into a rental home when I move. Fast forward: met the girl, married, moved out and actualized the plan in right about 2 years.

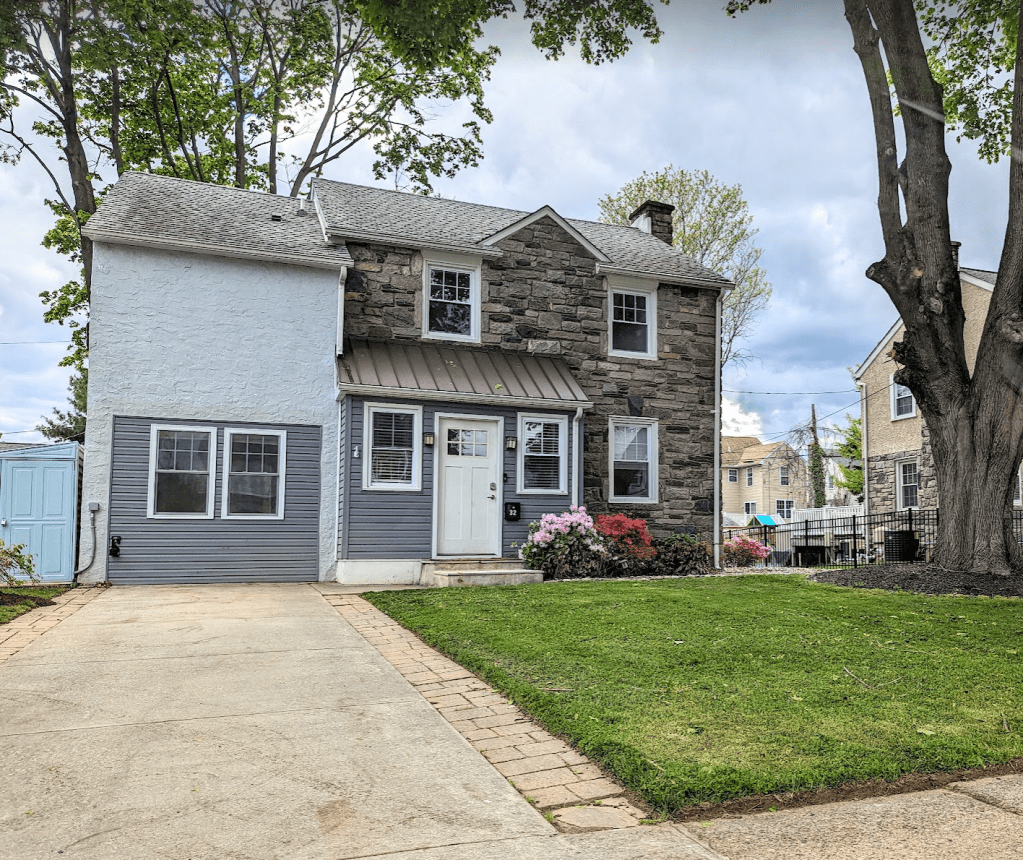

The Flipped Home (2018): The move brought us Delco, specifically Springfield, where we bought our starter home. We saw the home the first day it was on the market, made a competitive offer in a competitive market, and were under-contract a day later! This home was a flip from a 2 years prior, and while there weren’t as many DIY projects for me to sink myself into, we did learn a lot about the positives/negatives of buying a flipped home (i.e. floating the floors).

The Vacation Home, Poconos (2019): Shortly after moving, we got engaged in the home, married 5 months later, and with two incomes our financial picture allowed us to buy our first vacation home in Lake Harmony. The goal from the onset was to have it be a Short-Term Rental (think: Airbnb) as we did not want to commit to a 2nd mortgage completely out of pocket, and having the home “pay for itself” was an ambitious but realistic goal that we were able to execute on. After a long search, lots of back-and-forth and even “walking away from the deal”, we were able to negotiated a preferred sale price and launched in to the most important chapter of my professional career! We took off work and spent 9 days putting our own touches on the home, and during this time we learned that our first was on the way (Ella!). Seeing the vision coming together, I ended up leaving my job in advertising to stand-up my own rental management business (yes, leveraging data to conduct smart STR operations). This journey could be a book in and by itself, but the short version is we put a lot of work into this home, some we did and some we paid for, in order to bring the home to life and have it operate as a successful short-term rental.

Manayunk Sale and Shore Home (2021): We saw a lot of success in the short-term rental space, and we were at a cross-roads with our Manayunk home; reinvest into the home to “fix it up” more permanently or sell and take the cash. After having some troublesome tenants coupled with a favorable real-estate environment, we sold our Manayunk home for a sizeable profit in under 30 days (57% profit in 5 years), allowing us to reinvested the proceeds into a Shore Home in Wildwood. This home was far more “turn-key”, with less work being needed to fix it up, and we were able to rinse-repeat our strategy in turning it into another short-term rental. The shore market operated very differently than a mountain home, and we learned about the nuances of buying in Jersey as well as the considerations when considering a home that’s in a flood plain.

Real Estate License (2021): At this point, with our real estate activity picking up and my property management business thriving, I spent time studying for and passing my Real Estate Salesperson license.

Selling Springfield and The Forever Home (2023): The family continued to grow! We welcomed our 2nd (Carter) and we had a plan for our 3rd (Brooke), the only problem was we both worked from home and ran out of space… We considered an expansion to our home, but it ultimately wasn’t going to give us everything we were looking for, so we began our home search while preparing to sell our Springfield home. The challenge became: do you sell and then buy, or do you buy and then sell? For most, you need the proceeds from the sale in order to buy your next home, but the downside is it displaces you temporarily while you look for a new home, and you’re at the mercy of the market (i.e. if a home doesn’t pop up that you like then you might be living with your in-laws indefinitely!). Naturally, we really didn’t want to sell before buying, and we also didn’t have the liquid money in order to pull that off. We ended up getting clever and taking out a Home Equity Line of Credit on our Poconos home (which had appreciated in value considerably) as a bridge-loan of sorts. This allowed us to borrow money against the value we had in our Poconos home, for which we would pay back after selling. The process became: HELOC –> Buy Forever Home –> Sell Starter Home –> Use proceeds from sale to pay off HELOC. Worked beautifully, we found our forever home in Garnet Valley, saw it the first hour it was available for tours, put in an moderately aggressive offer to match our interest (we believed it to be under-priced) and closed within 30 days! This allowed us to move and then list our Springfield home. After moving, we spent a week fixing it up, painting the walls, touching up all those “kid” and “dog” marks, and ultimately had it under-contract within a week of it going on the market!

Conclusion and Everything After: 8 years later as a snapshot…

- Bought 5 homes

- Sold 2 homes

- Created a property management business, having managed over 150 homes

- Licensed Realtor and Real Estate Agent

I have since sold my property management business (2023) and have been winding down my day to day involvement in the business. Concurrently, I have decided to lean in fully as a licensed Realtor to not only help build out our personal real-estate portfolio but to also take a data-centric focus to Buying/Selling homes for my clients. In my experience, the buying/selling process has been more subjective than objective. “What do you want to list your home for?” and “What offer do you want to put in?” have been far too commonplace. While I’m a firm believer in letting the you (the client) have final say over offer and ask prices, I do believe its the real estate agent’s responsibility to lay out the facts to help them make an informed decision. Is it a hot market? Cold? Are there a lot of comparables? Is this the only home your interested in? How much time do you have? All of these factors should go into deriving a specific price based on confidence intervals, and that’s what I bring to the table; a data-first approach.

Service Area

Greater Philadelphia – This is where I call home, and have experience buying and selling homes from Manayunk to Garnet Valley and everywhere in between!

Poconos – I have sizable experience investing in and managing short-term rentals in the Poconos, and am well positioned to show and sell homes in the area.